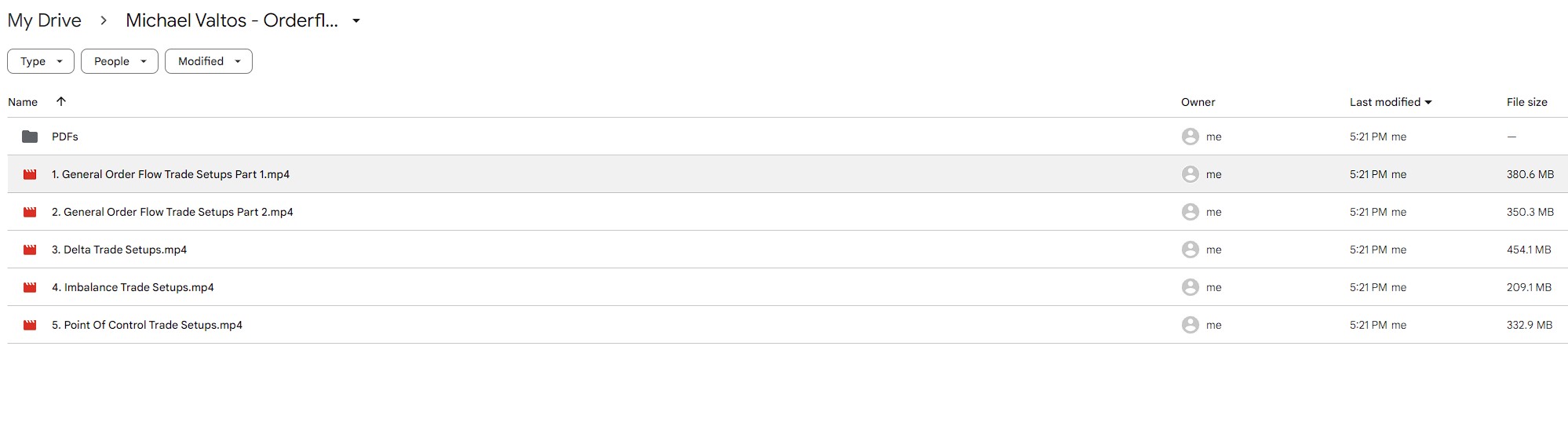

Michael Valtos – Orderflows Trade Opportunities Encyclopedia

Master Market Dynamics with Michael Valtos – Orderflows Trade Opportunities Encyclopedia

Navigating the complexities of the financial markets requires a deep understanding of market dynamics and trading strategies.

The Orderflows Trade Opportunities Encyclopedia, developed by seasoned trader Michael Valtos, is a comprehensive resource designed to equip traders with an extensive library of trade setups and opportunities based on order flow analysis.

Whether you’re a novice trader looking to build a solid foundation or an experienced trader seeking to refine your skills, this course offers invaluable insights and strategies to enhance your trading performance.

Why Choose the Orderflows Trade Opportunities Encyclopedia?

What Makes the Orderflows Trade Opportunities Encyclopedia Course Unique?

The Orderflows Trade Opportunities Encyclopedia course stands out due to its focus on order flow analysis, a powerful method for understanding market dynamics.

Order flow analysis involves studying real-time buying and selling activity to gain insights into market participants’ intentions.

By closely monitoring order flow data, traders can detect hidden buying or selling pressure, anticipate potential price movements, and identify high-probability trade setups.

Michael Valtos, an expert in interpreting order flow dynamics, brings his extensive knowledge and experience to this course.

He gives traders a detailed understanding of various trade setups and opportunities, ensuring that participants can make informed trading decisions in different market conditions.

The course covers many topics, including absorption patterns, iceberg orders, footprint charts, volume profile analysis, and market microstructure.

How Can the Orderflows Trade Opportunities Encyclopedia Transform Your Trading?

The Orderflows Trade Opportunities Encyclopedia by Michael Valtos is designed to transform your trading by providing you with the skills and knowledge needed to interpret order flow data and identify profitable trade setups.

By leveraging the insights and strategies this course presents, you can gain a competitive edge in the markets and enhance your profitability.

Through this course, you will learn to:

- Identify High-Probability Trade Setups: You will increase your chances of success by learning to recognize trade setups based on real-time order flow data.

- Understand Market Dynamics: Develop a deep understanding of market dynamics, including the behavior of market participants and the impact of order flow on price movements.

- Improve Trade Management and Risk Control: Learn effective trade management and risk control strategies to protect your capital and maximize your returns.

Key Concepts Covered in the Orderflows Trade Opportunities Encyclopedia

What Are Absorption Patterns and How Can They Benefit Traders?

Absorption patterns occur when market participants absorb a significant amount of buy or sell orders at a particular price level. Recognizing these patterns can help traders anticipate potential reversals or the continuation of trends.

In the Orderflows Trade Opportunities Encyclopedia, Michael Valtos provides detailed explanations of absorption patterns and how to identify them using order flow data.

By understanding absorption patterns, traders can make more informed decisions about when to enter or exit a trade. This knowledge can help traders capitalize on market movements and improve their overall trading performance.

The course includes real-world examples and case studies to illustrate how absorption patterns can be used effectively in trading.

How Do Iceberg Orders Influence Market Sentiment?

Iceberg orders, also known as hidden orders, are large orders that are partially displayed on the order book while the remainder is hidden. These orders can significantly influence market sentiment and potential price movements.

The Orderflows Trade Opportunities Encyclopedia provides insights into detecting and interpreting iceberg orders to gauge market sentiment and anticipate potential price movements.

By learning to identify iceberg orders, traders can better understand the market’s underlying buying or selling pressure. This information can be used to make more informed trading decisions and improve the accuracy of trade setups. The course covers various techniques for detecting iceberg orders and provides practical examples to help traders apply this knowledge in their trading.

What is the Role of Footprint Charts in Order Flow Analysis?

Footprint charts provide a detailed view of order flow data, including bid-ask spreads, market depth, and trade volume. These charts are essential tools for analyzing buying and selling pressure, support and resistance levels, and other key market dynamics.

In the Orderflows Trade Opportunities Encyclopedia, Michael Valtos teaches traders how to analyze footprint charts to gain valuable insights into market behavior.

By using footprint charts, traders can identify areas of high and low liquidity, potential supply and demand zones, and significant price levels. This information can be used to make more accurate trading decisions and improve overall trading performance.

The course includes detailed explanations and real-world examples to help traders effectively use footprint charts in their analysis.

How Can Volume Profile Analysis Enhance Trading Decisions?

Volume profile analysis involves analyzing the distribution of trading activity at various price levels. This analysis helps traders identify areas of high and low liquidity, potential supply and demand zones, and significant price levels.

The Orderflows Trade Opportunities Encyclopedia covers the principles of volume profile analysis and provides practical guidance on how to interpret volume profile charts.

By understanding volume profile analysis, traders can gain insights into market sentiment and potential price movements. This information can be used to identify high-probability trade setups and make more informed trading decisions. The course includes real-world examples and case studies to illustrate how volume profile analysis can be applied in trading.

What is Market Microstructure and Why is it Important?

Market microstructure refers to the intricacies of how financial markets operate, including the role of market makers, high-frequency trading algorithms, and other market participants.

Understanding market microstructure is essential for interpreting order flow dynamics and anticipating price movements.

The Orderflows Trade Opportunities Encyclopedia explores the various aspects of market microstructure and their impact on order flow analysis.

By gaining insights into market microstructure, traders can better understand the forces driving price movements and make more informed trading decisions.

The course provides detailed explanations of market microstructure concepts and their relevance to order flow analysis. Real-world examples and case studies are included to help traders apply this knowledge in their trading.

Trade Management and Risk Control

How Does the Course Address Trade Management and Risk Control?

Effective trade management and risk control are essential for successful trading. The Orderflows Trade Opportunities Encyclopedia provides strategies for managing trades, setting stop-loss orders, and adjusting position size based on market conditions.

Michael Valtos shares his expertise in trade management and risk control, ensuring that traders can protect their capital and maximize their returns.

By learning effective trade management and risk control strategies, traders can minimize their losses and improve their overall trading performance.

The course includes practical guidance and real-world examples to help traders implement these strategies in their trading.

What Real-World Examples and Case Studies are Included in the Course?

The Orderflows Trade Opportunities Encyclopedia includes numerous real-world examples and case studies illustrating various trade setups and opportunities.

These examples provide practical insights and help traders understand how to apply the concepts and strategies presented in the course. By analyzing these examples, traders can gain valuable experience and improve their trading skills.

The course covers a wide range of market conditions and trading scenarios, ensuring that traders are well-prepared to navigate different market environments. The real-world examples and case studies provide a comprehensive understanding of order flow analysis and its application in trading.

Conclusion: Why the Orderflows Trade Opportunities Encyclopedia is a Must-Have

Exploring Michael Valtos’ Orderflows Trade Opportunities Encyclopedia reveals its profound impact on the world of trading. With its comprehensive coverage of order flow analysis, practical strategies, and real-world examples, this course offers invaluable resources for traders looking to enhance their skills and profitability.

The success stories and positive reviews highlight the effectiveness of Michael Valtos’ methods, demonstrating how the course can transform your trading performance. Whether you’re a novice trader looking to build a solid foundation or an experienced trader seeking to refine your skills, the Orderflows Trade Opportunities Encyclopedia is a must-have resource.

Enrol in the Orderflows Trade Opportunities Encyclopedia course today and take the first step towards mastering order flow analysis and achieving success in your trading endeavours.

Frequently Asked Questions

What is the Orderflows Trade Opportunities Encyclopedia?

The Orderflows Trade Opportunities Encyclopedia by Michael Valtos is a comprehensive resource designed to provide traders with an extensive library of trade setups and opportunities based on order flow analysis.

How does the course improve trading performance?

The course teaches traders how to interpret order flow data, identify high-probability trade setups, and make informed trading decisions. It covers various topics, including absorption patterns, iceberg orders, footprint charts, volume profile analysis, and market microstructure.

Who can benefit from the Orderflows Trade Opportunities Encyclopedia?

The course is beneficial for traders of all levels, from novices looking to build a solid foundation to experienced traders seeking to refine their skills and enhance their profitability.

What are the key features of the course?

The course covers various trade setups and opportunities based on order flow analysis. It includes real-world examples and case studies, practical strategies for trade management and risk control, and detailed explanations of market dynamics and order flow concepts.

What do users say about the course?

Users praise the course for its comprehensive coverage, practical insights, and real-world examples. They highlight the effectiveness of Michael Valtos’ methods in improving their trading performance and achieving success in the markets.