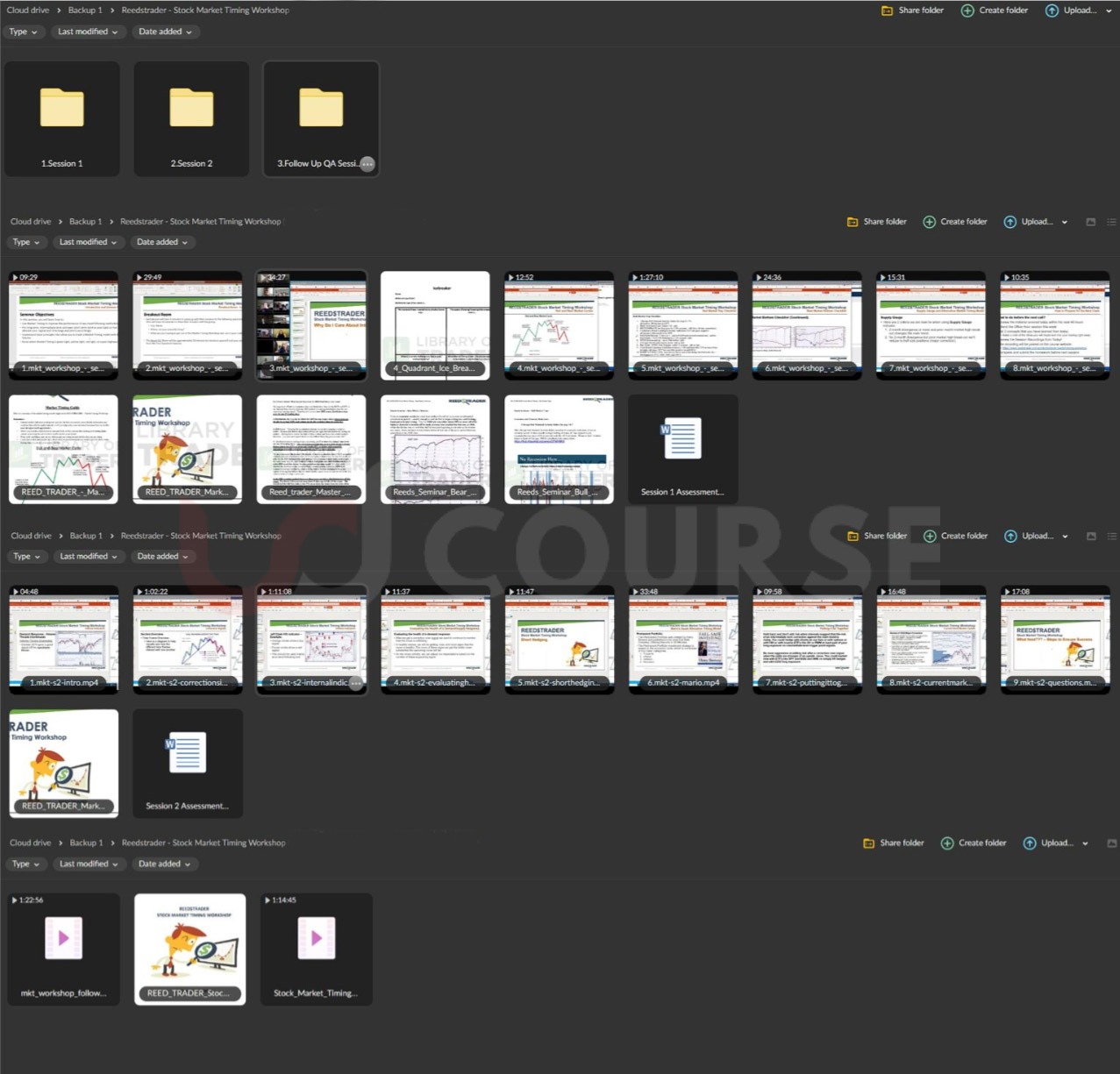

Reedstrader – Stock Market Timing Workshop

Reedstrader – Stock Market Timing Workshop: Mastering the Art of Timing the Market

Unlock the secrets of market timing with the Reedstrader Stock Market Timing Workshop course, a comprehensive program designed to help investors master the art of timing the stock market.

Learn to identify optimal entry and exit points, maximize profitability, and minimize risk with techniques grounded in technical analysis, market cycles, and investor sentiment. This course is an essential investment for anyone looking to improve their trading accuracy and confidence.

Why Choose the Reedstrader Stock Market Timing Workshop Course?

Are you tired of making trading decisions based on guesswork? Do you want to enhance your trading accuracy and reduce risks?

The Reedstrader Stock Market Timing Workshop course offers actionable insights and practical techniques for analyzing market trends and anticipating price movements. Led by Reedstrader, a seasoned trader and market timing expert, this workshop delves into the intricacies of market timing for maximum profit potential. Participants will gain the tools needed to make informed trading decisions and achieve consistent returns in the stock market.

What is Technical Analysis and How Can It Benefit You?

What Techniques Will You Learn?

In this Stock Market Timing Workshop course, you will learn how to utilize technical indicators, chart patterns, and price action analysis. These techniques will help you identify trend reversals, support and resistance levels, and trading opportunities.

You’ll gain expertise in interpreting moving averages, oscillators, and volume indicators to gauge market momentum and confirm trading signals. These tools are essential for any trader looking to enhance their market analysis and trading strategy.

How Can These Techniques Improve Your Trading?

By mastering technical analysis, you can identify high-probability trading opportunities. This will empower you to make more accurate trading decisions and increase profitability. The course provides practical strategies that can be directly applied to your trading routine, enabling you to capitalize on market trends and achieve consistent returns.

What Are Market Cycles and Why Should You Care?

How Do Market Cycles Impact Your Trading?

Understanding market cycles is crucial for timing the market effectively. The Reedstrader course offers insights into the phases of market cycles, including expansionary and contractionary phases, bull and bear markets, and sector rotations. By learning to identify cyclical patterns, you can time market tops and bottoms and adjust your trading strategies accordingly.

How Can Market Cycle Analysis Enhance Your Trading Performance?

By mastering market cycle analysis, you can anticipate price movements and make informed decisions about when to enter or exit trades. This knowledge helps you align your trading strategies with market trends, increasing your chances of success and profitability. The Reedstrader Stock Market Timing Workshop course equips you with the skills needed to navigate market cycles effectively.

How Does Sentiment Analysis and Market Psychology Affect Your Trades?

What Methods Will You Learn for Analyzing Investor Sentiment?

The Reedstrader course teaches methods for analyzing investor sentiment, market psychology, and behavioral biases. Understanding these factors is essential for gauging market sentiment and identifying sentiment extremes. You will learn to use sentiment indicators, such as the put/call ratio, VIX, and investor surveys, to assess market sentiment and identify contrarian trading opportunities.

How Can Sentiment Analysis Improve Your Trading Strategy?

By incorporating sentiment analysis into your trading strategy, you can make more informed decisions and capitalize on market sentiment shifts. This approach allows you to anticipate market movements and position yourself for profit. The Reedstrader Stock Market Timing Workshop course provides the tools and techniques needed to integrate sentiment analysis into your trading plan.

What Are the Best Practices for Risk Management and Trade Execution?

How Can You Manage Risk Effectively?

Risk management is a critical aspect of successful trading. The Reedstrader course offers techniques for managing risk, setting stop-loss orders, and implementing proper position sizing to protect your capital. These strategies help you minimize losses and preserve your capital during adverse market conditions.

What Are the Key Strategies for Trade Execution?

Executing trades with precision is essential for maximizing profitability and minimizing slippage. The course teaches strategies for entry and exit tactics, trade timing, and order placement. By mastering these techniques, you can improve your trade execution and enhance your overall trading performance.

What Are the Benefits of the Reedstrader Stock Market Timing Workshop Course?

How Can This Course Improve Your Trading Accuracy and Profitability?

The Reedstrader Stock Market Timing Workshop course empowers participants to make more accurate trading decisions and increase profitability by timing the market effectively. The tools and techniques taught in the course help identify high-probability trading opportunities and capitalize on market trends for consistent returns.

How Does This Course Help Reduce Risk and Drawdowns?

Effective risk management strategies and trade execution tactics taught in the course help participants minimize trading losses and reduce portfolio drawdowns. By implementing these strategies, you can preserve capital during adverse market conditions and avoid significant losses during market downturns.

How Can This Course Enhance Your Trading Confidence and Discipline?

The systematic approach to market timing and trading provided by the Reedstrader course builds participants’ confidence and discipline. By equipping traders with the knowledge and skills needed to stay disciplined and avoid emotional decision-making, the course helps you stick to your trading plan and achieve consistent results.

What Makes the Reedstrader Course a Continuous Learning Experience?

How Does the Course Foster Continuous Learning and Improvement?

The Reedstrader Stock Market Timing Workshop course fosters a culture of continuous learning and improvement by providing ongoing support, mentorship, and resources. Participants have opportunities for networking, idea sharing, and collaboration with fellow traders, enhancing their learning and trading performance.

What Do Participants Say About the Course?

“Reedstrader’s Stock Market Timing Workshop has transformed my trading approach and helped me achieve consistent profits in the market,” says an active trader. Another workshop participant notes, “The practical strategies and insights shared in the workshop have enabled me to improve my market timing skills and become a more disciplined trader.”

Conclusion: Why is the Reedstrader Stock Market Timing Workshop Course Worth It?

The Reedstrader Stock Market Timing Workshop course equips participants with the knowledge and tools needed to master the art of timing the stock market.

Focusing on technical analysis, market cycles, sentiment analysis, and risk management can help participants improve trading accuracy, reduce risk, and achieve consistent profitability.

Whether you are a novice trader or an experienced investor, this course provides invaluable insights and techniques to enhance your trading performance.

Invest in your trading future with the Reedstrader Stock Market Timing Workshop course and unlock the secrets of market timing today.