Macrohedged – Options Education

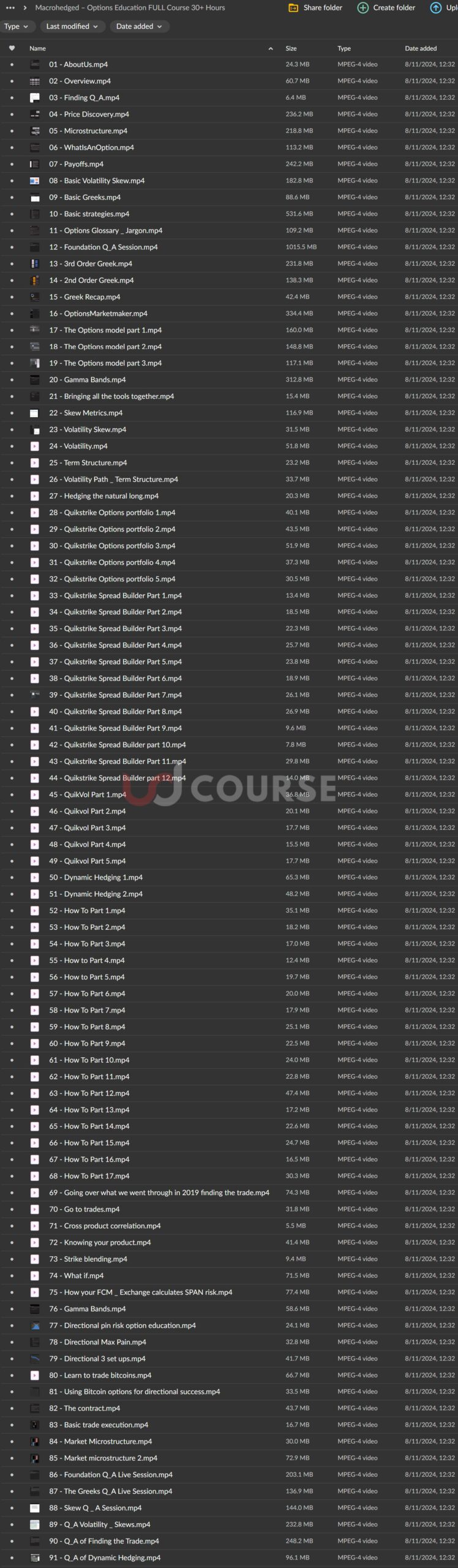

Options Education FULL Course 30 Hours: Master the World of Options Trading with Macrohedged

Navigating the world of options trading can be complex and intimidating, but with the Options Education FULL Course 30 hours from Macrohedged, you’ll have the knowledge and skills to trade confidently.

Whether you’re a beginner looking to break into the world of options or an experienced trader seeking to enhance your expertise, this comprehensive course offers over 30 hours of in-depth learning. This program is designed to help you understand the fundamentals, advanced strategies, and the intricacies of options trading.

This course covers everything you need to know about options, from foundational principles to advanced techniques. Learn how to assess market microstructure, trade options on futures, evaluate volatility, and hedge your positions effectively. If you’re ready to take your options trading to the next level, this Options Education FULL Course 30 course is the perfect opportunity.

What Does the Macrohedged Course Offer?

What Are the Key Features of the Options Education FULL Course 30 Hours?

The Options Education FULL Course 30 course by Macrohedged is divided into two main sections: Foundation Day and DeepDive. These sections are carefully structured to ensure that participants build a solid understanding of options trading, progressing from basic concepts to advanced topics. Here’s an overview of what each section covers:

- Foundation Day: This section introduces the core principles of options trading. You’ll start by learning market microstructure, trading options on futures, and the fundamental concepts of the options market. By the end of Foundation Day, you will have a firm grasp of the essentials, including market exchanges, the Greeks (delta, gamma, theta, vega), and option valuation.

- DeepDive: After mastering the basics, the DeepDive section introduces advanced strategies and trading techniques. This includes learning about trading spreads, the Black-Scholes model, volatility trading, skew trading, and dynamic hedging. You’ll also explore position risk and understand how market makers operate.

This comprehensive structure ensures that by the end of the course, you will have a thorough understanding of options trading, enabling you to make informed decisions in the market.

Why Should You Take the Options Education FULL Course 30 Hours?

Investing in the Options Education FULL Course 30 course is a smart decision for anyone serious about options trading. Here are the key reasons why you should consider enrolling:

- Comprehensive Knowledge: This course covers everything from the basics of options trading to more advanced topics like volatility, skew trading, and dynamic hedging, making it suitable for traders at any level of expertise.

- Hands-On Learning: The course includes interactive sessions, exercises, and case studies that allow you to practice and apply what you’ve learned in real-world trading scenarios.

- Expert Insights: Gain valuable knowledge from industry experts with extensive options trading experience. This ensures that you learn strategies that work in real markets.

By the end of the Macrohedged course, you’ll have the confidence to navigate the complexities of the options market and execute trades successfully.

What Will You Learn in the Options Education FULL Course?

How Does the Options Education FULL Course 30 Course Teach Options Fundamentals?

The Options Education FULL Course 30 course begins with a strong focus on foundational knowledge. This is crucial for both new traders and those looking to refresh their understanding of the options market. Here are some of the fundamental concepts covered:

- Market Microstructure: You’ll learn how the market is organized and how different players (traders, market makers, institutions) interact within it. Understanding market microstructure is key to making informed trading decisions.

- Options on Futures: This section introduces you to the world of trading options on futures contracts. You’ll explore the CME, EUREX, and ICE exchanges and understand how each exchange operates differently.

- The Greeks: The course provides an in-depth look at the Greeks—delta, gamma, theta, and vega—and explains how they affect option pricing and risk. Mastering the Greeks will make you better equipped to evaluate and manage your option positions.

These fundamentals are critical for any trader looking to build a solid foundation in options trading.

How Does the Macrohedged Course Equip You for Advanced Trading?

Once you’ve mastered the basics, the DeepDive section of the Macrohedged course introduces you to advanced trading strategies that can help you succeed in more complex market environments. This includes:

- Trading Spreads: Learn about different spread strategies, such as vertical, horizontal, and diagonal spreads. These techniques allow you to manage risk and maximize potential profits by taking advantage of market movements.

- Volatility Trading and Skew: The course covers the concept of volatility and teaches you how to trade volatility using advanced strategies. You’ll also learn how to trade skew, including risk reversals (RR), butterflies (BF), and route trading, helping you navigate the subtleties of market volatility.

- Dynamic Hedging: In this section, you’ll discover how to hedge your options positions dynamically. This technique allows you to adjust your hedge as the market moves, reducing risk and protecting your portfolio.

These advanced strategies are essential for experienced traders looking to refine their techniques and improve their performance in the options market.

Who Is the Options Education FULL Course 30 Hours For?

Is the Macrohedged Course Suitable for Beginners?

Yes, the Macrohedged – Options Education FULL Course 30 Hours is designed for traders of all experience levels. The course starts with fundamental concepts that provide a solid foundation for beginners while also offering advanced strategies for more experienced traders. Here’s why it’s suitable for all levels:

- Beginners: For those new to options trading, the Foundation Day section of the course provides a step-by-step introduction to key concepts, ensuring you have a clear understanding of the basics before moving on to more advanced topics.

- Intermediate and Advanced Traders: If you already have some experience with options trading, the DeepDive section offers more sophisticated strategies like dynamic hedging and volatility trading, allowing you to refine your skills further.

No matter your experience level, the Options Education FULL Course 30 course provides valuable insights that can help you become a more successful trader.

Who Can Benefit the Most from the Options Education FULL Course?

The Macrohedged course is particularly beneficial for:

- Traders Seeking to Enhance Their Skills: Whether you’re a beginner or an experienced trader, this course will help you sharpen your trading strategies and increase your understanding of options markets.

- Investors Looking to Diversify Their Portfolio: If you’re looking to diversify your portfolio with options trading, this course will provide you with the necessary knowledge to make informed investment decisions.

- Financial Professionals: For professionals working in finance, understanding options trading is a valuable skill that can enhance your career. This course will give you the in-depth knowledge you need to confidently trade options.

By the end of the Options Education FULL Course 30 course, you’ll be better equipped to make strategic trades and manage risk effectively in the options market.

What Are the Benefits of Enrolling in the Macrohedged Options Education Course?

How Will the Options Education FULL Course 30 Hours Improve Your Trading?

The Options Education FULL Course 30 course offers several key benefits for traders:

- Comprehensive Knowledge: You’ll gain a deep understanding of options trading, from foundational concepts to advanced strategies like volatility trading and dynamic hedging.

- Practical Application: With interactive exercises and real-world case studies, the course ensures that you can apply the strategies you’ve learned to actual trading scenarios.

- Risk Management: Learn how to assess and manage the risks associated with options trading, helping you protect your portfolio from market volatility.

These benefits will empower you to trade with confidence and maximize your returns in the options market.

Why Should You Choose the Macrohedged Course Over Others?

The Macrohedged course stands out for several reasons:

- Expert Instructors: The course is taught by seasoned professionals with extensive experience in options trading, ensuring that you receive top-quality education and insights.

- Thorough Curriculum: Covering both foundational knowledge and advanced strategies, this course provides a comprehensive learning experience that few others can match.

- Flexible Learning: With over 30 hours of content, you can learn at your own pace and revisit material as needed, making it easy to fit the course into your schedule.

The Options Education FULL Course 30 course is an investment in your trading future, providing you with the skills and knowledge to succeed in the fast-paced world of options trading.

Conclusion: Why You Should Enroll in the Macrohedged Options Education FULL Course Today

The Macrohedged – Options Education FULL Course 30+ Hours is an exceptional resource for anyone looking to master the art of options trading. With its comprehensive curriculum, expert insights, and practical application, this course offers everything you need to build a successful career in trading.

Whether you’re a novice seeking to understand the basics or an experienced trader looking to refine your strategies, the Options Education FULL Course 30 course is the ultimate guide to options trading.

Take the next step in your trading journey and enroll today—your future success in the options market awaits.