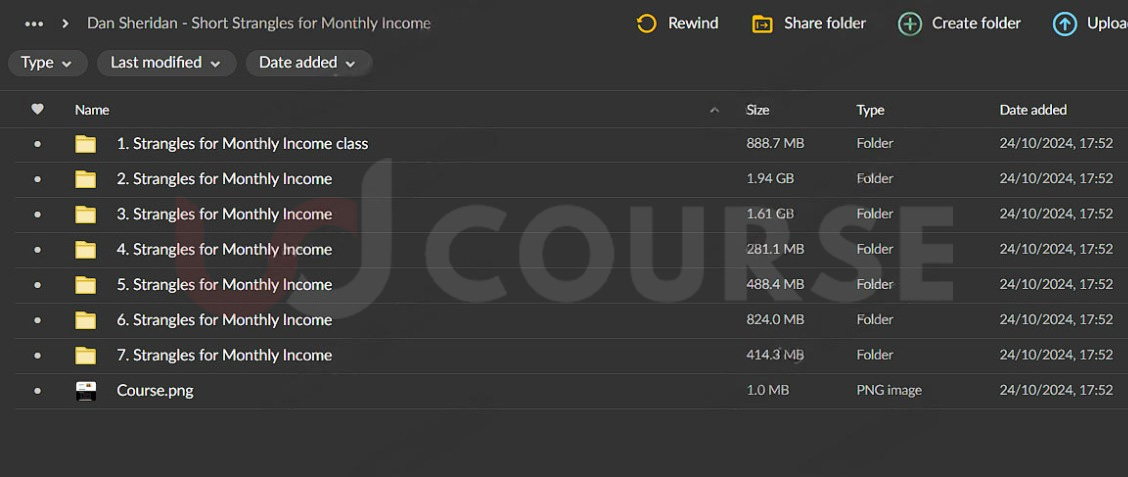

Dan Sheridan – Short Strangles for Monthly Income

Short Strangles for Monthly Income Course: A Profitable Approach to Consistent Options Trading

Looking for a reliable options strategy that brings in steady monthly income? The Dan Sheridan – Short Strangles for Monthly Income course is an excellent choice for traders who want to leverage market stagnation and limited price movement.

This course, led by seasoned options expert Dan Sheridan, offers traders an actionable, conservative approach to generating consistent income.

It combines the technical strategy of short strangles with practical risk management techniques, making it ideal for maximising returns while keeping risk under control.

What Will You Gain from the Short Strangles for Monthly Income Course?

This course provides a complete roadmap to mastering short strangles, enabling traders to turn low-volatility markets into consistent income opportunities.

You’ll learn the intricacies of this neutral options strategy, where both put and call options are sold on the same underlying asset, and understand how to utilize theta decay for steady returns. Beyond the basics, the course covers critical adjustments and risk management methods so that you can confidently handle unexpected market shifts while protecting your capital.

This blend of strategic knowledge and real-world application positions Dan Sheridan’s Short Strangles course as a must-have for traders seeking monthly income with manageable risk.

How Can the Short Strangles for Monthly Income Course Help You Profit in Low-Volatility Markets?

In a market with limited price movements, the short strangle strategy is particularly effective, allowing traders to profit from minimal fluctuations.

In this course, Dan Sheridan teaches how to evaluate low-volatility markets and explains the characteristics that make these environments suitable for short strangles.

You’ll gain insights into selecting underlying assets with low price movement, enhancing your chances of generating monthly income. Dan’s focus on adapting short strangles to various market conditions ensures that you can maximize returns even when market volatility is low.

What Is a Short Strangle and How Does It Generate Income?

A short strangle involves simultaneously selling a put and a call option on the same asset. Dan Sheridan’s course breaks down this strategy step by step, covering the importance of selecting the right strike prices and expiration dates.

You’ll learn how to structure trades to leverage theta decay, the natural time-based erosion in option prices, which translates into income for options sellers.

As the course dives into selecting expiration dates and strike prices, you’ll discover how to set up your trades for optimal monthly income generation, making this a reliable strategy for income-focused traders.

How Does the Course Teach Risk Management and Adjustment Techniques?

Managing risk is crucial in options trading, and this course is tailored to help traders minimize downside risk. Dan Sheridan’s Short Strangles for Monthly Income course offers a comprehensive approach to risk management, guiding traders through stop-loss settings, capital allocation, and adjustment strategies. You’ll learn how to roll positions and diversify your short strangles across multiple assets to protect your portfolio from adverse market movements.

These strategies not only help minimize losses but also enable traders to maintain a strong risk-to-reward ratio, preserving capital over time.

How Can You Maximize Monthly Returns with Short Strangles?

The goal of this course is to help you achieve consistent monthly income, and it covers every aspect of maximizing these returns. Dan Sheridan emphasizes the role of theta decay, explaining how timing short strangles can lead to predictable returns.

He also covers premium collection techniques, showing you how to set up positions that optimize income generation each month.

By focusing on monthly returns, Dan’s Short Strangles for Monthly Income course equips you with a sustainable method to build wealth over time through disciplined options selling.

What Trade Adjustments Will You Learn in the Dan Sheridan Course?

Market conditions change, and the ability to adjust trades is essential for protecting profits. In this course, Dan Sheridan teaches practical adjustment techniques, including position rolling, converting trades, and setting stop-loss levels.

You’ll learn when and how to adjust your positions to minimize losses and maximize gains, even in shifting market environments. These strategies provide traders with flexibility, helping them to optimize profits and manage risk dynamically as they respond to market fluctuations.

Why Is This Course Suited for Intermediate and Advanced Traders?

While beginners can still learn from Dan Sheridan’s teachings, the course is particularly suited to those with a foundation in options trading.

The Short Strangles for Monthly Income course offers a deep dive into advanced options strategies, risk management, and trade adjustments, making it ideal for intermediate and advanced traders seeking to refine their skills. Dan’s thorough, systematic approach makes complex concepts accessible, while still challenging experienced traders to improve their income-generating capabilities.

What Real-World Examples and Case Studies Are Included in the Course?

Theory alone isn’t enough to make profitable trades, so Dan Sheridan’s course includes real-world examples and live trading sessions. Case studies illustrate how short strangles function in different market scenarios, allowing students to see how theory is applied to actual trades.

Live sessions with Dan offer insights into real-time decision-making, from setting up trades to managing risk. This hands-on approach enables traders to gain confidence and experience, giving them a clearer understanding of how to apply these strategies in their own trading.

How Does Dan Sheridan’s Expertise Benefit Traders?

Dan Sheridan is a highly regarded options trader and instructor with decades of experience in the industry. His focus on conservative, income-generating strategies has helped thousands of traders succeed.

Dan distills his expertise into actionable strategies and risk management principles in the Short Strangles for Monthly Income course.

This unique learning opportunity gives traders direct access to an expert who understands not only the theoretical aspects of short strangles but also their practical application in the real world.

Is the Short Strangles for Monthly Income Course Right for You?

If you’re an options trader looking for a consistent, reliable strategy to generate monthly income, this course is designed for you. It combines the fundamental principles of short strangles with advanced techniques for managing risk and adjusting positions.

The focus on income generation through disciplined options selling makes it a standout choice for traders who value consistency. With Dan Sheridan’s guidance, you’ll develop a robust approach to trading short strangles, enabling you to navigate different market conditions confidently.

Conclusion: Build a Steady Monthly Income with Dan Sheridan’s Proven Strategy

The Dan Sheridan – Short Strangles for Monthly Income course provides options traders with a powerful strategy for generating steady returns.

By focusing on short strangles in low-volatility environments, traders can use theta decay to build a consistent income.

With Dan Sheridan’s expert instruction, you’ll learn how to manage risk, adjust trades, and maximize monthly income, giving you the tools needed for long-term success in options trading.