Axia Futures – Trading with Price Ladder and Order Flow Strategies

Master Market Dynamics with Axia Futures – Trading with Price Ladder and Order Flow Strategies Course

Understanding market dynamics and making informed trading decisions requires more than just reading charts.

To truly excel, traders need to delve into the nuances of price ladders and order flow strategies, which can provide unparalleled insights into market behavior.

The Axia Futures – Trading with Price Ladder and Order Flow Strategies Course is designed to equip traders of all levels with the skills and knowledge to leverage these advanced trading techniques effectively.

Whether you’re a beginner looking to build a strong foundation or an experienced trader aiming to refine your strategy, this course offers a comprehensive roadmap to mastering market microstructure.

What Makes the Trading with Price Ladder and Order Flow Strategies Course Unique?

The Trading with Price Ladder and Order Flow Strategies Course stands out because it focuses on practical, real-world trading scenarios. The course content is structured to provide a deep understanding of how price ladders and order flow can be used to anticipate market movements and make more accurate trading decisions.

The course blends theoretical knowledge and hands-on practice to ensure that participants learn the concepts and how to apply them in live trading environments.

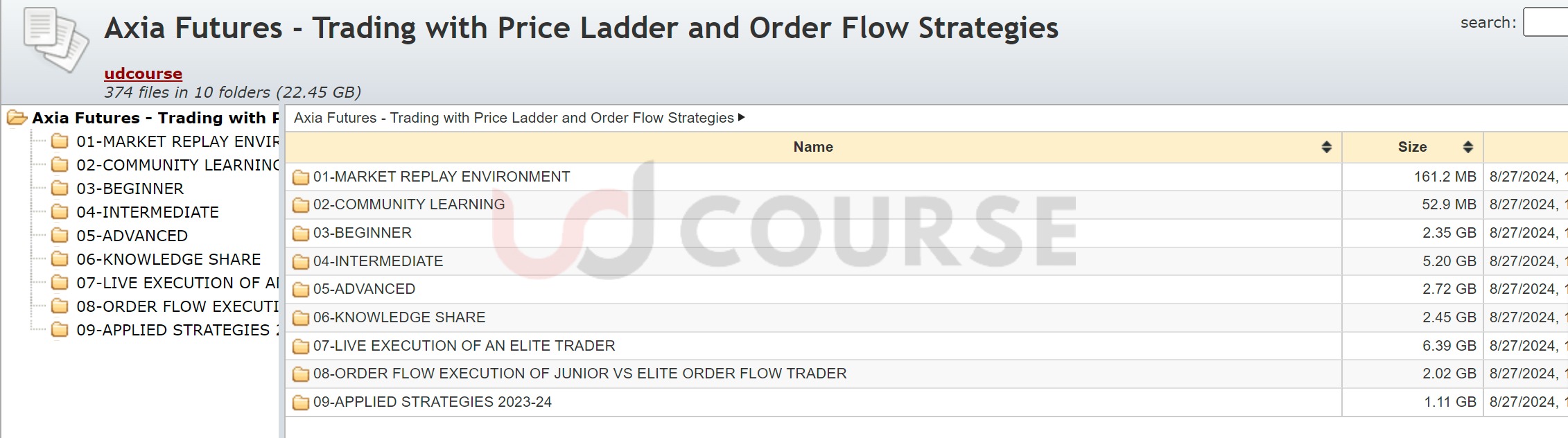

Axia Futures, a renowned name in the trading education industry, has designed this course with meticulous attention to detail. The course is divided into several modules, each targeting specific aspects of trading with price ladders and order flow strategies.

From beginner-level introductions to advanced trading tactics, the course provides a step-by-step guide to mastering these essential trading tools.

How Does the Trading with Price Ladder and Order Flow Strategies Course Benefit Traders?

The Axia Futures course offers numerous benefits that can significantly enhance your trading performance. By focusing on price ladders and order flow, the course helps traders gain insights that are often missed by traditional chart analysis.

Here are some of the key benefits:

Develop a Deeper Understanding of Market Microstructure

One of the primary advantages of the Trading with Price Ladder and Order Flow Strategies Course is its emphasis on market microstructure. This course teaches you how to read the price ladder, also known as the DOM (Depth of Market), to identify the intentions of different market participants.

By understanding who is buying or selling at different price levels, you can anticipate potential market moves more accurately. This level of insight is invaluable for traders looking to gain an edge in highly competitive markets.

Learn to Identify and React to High-Frequency Trading (HFT) Patterns

The course delves into the world of High-Frequency Trading (HFT), a crucial element in today’s markets. Through the intermediate modules, you’ll learn how to spot HFT patterns and understand their impact on market behavior. Recognizing these patterns allows you to avoid potential traps set by algorithmic traders and align your strategy accordingly. This knowledge is particularly useful for day traders and scalpers who operate in fast-moving markets.

Master Advanced Order Flow Strategies

As you progress through the Axia Futures course, you’ll encounter advanced modules that cover complex order flow strategies. These include market flipping, layering, spoofing, and various other order flow price patterns that can signal potential reversals or breakouts.

By mastering these strategies, you’ll be better equipped to confidently execute trades, knowing that a solid understanding of market dynamics backs your decisions.

What Can You Expect to Learn from the Axia Futures Course?

The Trading with Price Ladder and Order Flow Strategies Course is divided into several modules, each catering to different skill levels and trading strategies. Here’s a breakdown of what you can expect to learn:

Beginner Modules: Building a Strong Foundation

The course begins with a series of beginner modules that lay the groundwork for understanding price ladders and order flow. In these modules, you will:

- Learn the Basics of Order Flow: The course introduces you to the fundamentals of order flow, explaining how it differs from traditional chart analysis and why it’s crucial for modern trading.

- Understand the Market Replay Environment: You’ll learn how to activate, set up, and use the Market Replay Environment, a powerful tool for practicing and refining your strategies in a simulated market setting.

- Explore What the Ladders Tell You That Charts Don’t: Gain insights into the unique information provided by price ladders, such as order book dynamics and liquidity levels, which are often hidden from traditional chart views.

Intermediate Modules: Diving Deeper into Market Dynamics

The intermediate modules take your knowledge to the next level, focusing on more complex concepts and strategies:

- Analyze Market Participants and High-Frequency Trading: Learn about the different market participants, including algorithmic and HFT traders, and how their actions influence market behavior.

- Discover Order Flow Price Patterns: The course introduces you to various order flow price patterns, helping you identify key market turning points and potential breakout opportunities.

- Understand Large Orders and Absorption Events: Learn how to identify large orders in the order book and understand absorption events, which can signal significant market moves.

Advanced Modules: Mastering Order Flow Strategies

The advanced modules are where the course truly shines, offering in-depth training on sophisticated trading strategies:

- Trend Reversal Indicators: You’ll learn how to identify trend reversal signals through order flow indicators, a critical skill for traders looking to capitalize on market turning points.

- Momentum Breakout Strategies: The course covers momentum breakout patterns, teaching you how to spot and trade these high-probability setups.

- Practice Confluence of Strategies: Finally, you’ll practice combining various order flow strategies to create a robust trading plan, tailored to your specific trading style.

What Are the Real-World Applications of the Trading with Price Ladder and Order Flow Strategies Course?

The Axia Futures course is not just about theory; it’s designed to prepare you for real-world trading challenges. Here are some of the practical applications you’ll gain from this course:

Improve Your Execution with Market Replay

One of the unique features of this course is the Market Replay Environment. This tool allows you to replay historical market data and practice your order flow strategies in a risk-free setting. By repeatedly executing trades in this environment, you can fine-tune your timing and decision-making process, leading to better performance in live markets.

Learn from Elite Traders

The course includes live analysis and interviews with elite order flow traders. By observing how these professionals analyze the market and execute trades, you can gain insights into the habits and strategies that set successful traders apart. This real-world exposure is invaluable for developing a professional trading mindset.

Apply Advanced Strategies in Live Markets

After completing the advanced modules, you’ll be equipped with a range of strategies that you can apply directly in live markets. Whether you’re trading equities, futures, or other instruments, the skills you gain from this course will enable you to navigate different market conditions confidently.

Why Should You Choose Axia Futures for Learning Trading with Price Ladder and Order Flow Strategies?

Choosing the right trading course can significantly impact your trading career. Here’s why the Axia Futures – Trading with Price Ladder and Order Flow Strategies Course is the ideal choice for serious traders:

Proven Track Record of Success

Axia Futures has a well-established reputation in the trading education space, known for consistently producing successful traders. The curriculum is designed by experienced traders who understand the market’s challenges and know what it takes to succeed.

Comprehensive and Structured Learning

The course is structured to provide a clear learning path, from beginner to advanced levels. This step-by-step approach ensures you build a strong foundation before moving on to more complex strategies, making the learning process more effective and manageable.

Access to a Supportive Community

When you enroll in the Axia Futures course, you’re getting access to top-tier educational content and joining a community of like-minded traders.

The course encourages community learning through strategy video sharing and group discussions, allowing you to learn from your peers and share your own insights.

Conclusion: Elevate Your Trading Game with Axia Futures

In a fiercely competitive market, having an edge is crucial. The Axia Futures—Trading with Price Ladder and Order Flow Strategies Course offers that edge by equipping you with the knowledge and skills to understand and exploit market dynamics.

From beginner to advanced levels, the course provides a comprehensive education in price ladder and order flow strategies, supported by real-world applications and community learning.

Don’t leave your trading success to chance. Enroll in the Trading with Price Ladder and Order Flow Strategies Course today and start mastering the strategies that can take your trading to the next level.