Trader Daye Quarterly Theory 2024 (21 Videos)

Trader Daye Quarterly Theory 2024 Course: Master the Markets with a Long-Term Trading Perspective

Are you ready to elevate your trading strategy by harnessing the power of long-term market cycles?

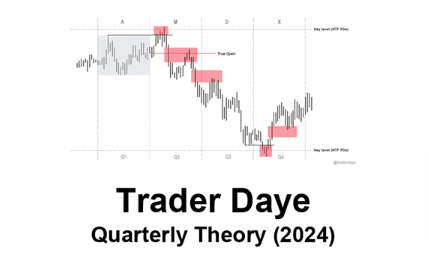

The Trader Daye Quarterly Theory 2024 Course offers an advanced approach to trading that focuses on quarterly cycles and long-term trends. Developed by the experienced trader, Trader Daye, this course provides traders with a comprehensive framework to analyze markets, identify trading opportunities, and manage risk effectively over a quarterly timeframe.

With 21 videos packed with insights and strategies, this course empowers traders to move beyond short-term fluctuations and capture larger market trends for potentially greater profits.

Why Choose the Trader Daye Quarterly Theory 2024 Course?

The Trader Daye Quarterly Theory 2024 Course is unlike other trading programs emphasising quick gains from short-term trades. Instead, it offers a holistic approach that considers the broader, longer-term trends that play out over quarters.

This strategy is designed for traders who want to take a strategic and patient approach to the financial markets.

This Trader Daye Quarterly Theory 2024 course focuses on quarterly cycles, enabling traders to make informed decisions based on larger market movements.

This reduces the noise and random fluctuations that often lead to impulsive and risky trades.

This course emphasizes discipline, patience, and strategic planning, making it ideal for traders who want to achieve sustainable, long-term profitability.

What Is the Trader Daye Quarterly Theory and How Does It Work?

The Trader Daye Quarterly Theory 2024 is a trading strategy built around the idea that quarterly cycles provide valuable insights into market trends.

Instead of focusing on stock price fluctuations on a minute-by-minute or day-by-day basis, the theory looks at longer-term trends that develop over a quarter to three months.

These cycles can reveal larger patterns and give traders the ability to align their strategies with broader market movements.

Recognizing Long-Term Market Cycles

One of the key principles of the Trader Daye Quarterly Theory 2024 is the recognition of quarterly market cycles.

Trader Daye teaches participants how to identify and capitalize on these cycles, which often indicate more significant market trends that might be missed in the noise of daily trading. By focusing on these cycles, traders can position themselves for higher probability trades and avoid catching up in short-term market noise.

Combining Fundamental and Technical Analysis

The Trader Daye Quarterly Theory 2024 course blends fundamental and technical analysis to create a robust trading framework. Fundamental analysis involves evaluating economic indicators, corporate earnings reports, and geopolitical events to assess market health and predict future price movements.

Simultaneously, participants learn to apply technical analysis techniques such as trend lines, chart patterns, and oscillators to pinpoint the best entry and exit points for trades.

This combination ensures that traders have a well-rounded approach to their trading strategy.

How Does the Trader Daye Quarterly Theory Help Identify Trading Opportunities?

The Trader Daye Quarterly Theory 2024 course teaches traders how to spot high-probability trading opportunities by recognizing the most important market signals.

Through fundamental analysis and technical patterns, traders understand how to anticipate potential market movements.

Analyzing Fundamental Data

Fundamental data provides crucial insights into the health of a market or sector. In the Trader Daye Quarterly Theory 2024, participants learn how to interpret economic data, earnings reports, and geopolitical news to anticipate potential market movements. For example, a company’s earnings performance over several quarters might signal an upcoming trend in its stock price, allowing traders to position themselves accordingly.

Utilizing Technical Analysis for Precise Timing

Technical analysis plays a critical role in the Trader Daye Quarterly Theory 2024 course. Participants will gain proficiency in interpreting charts, identifying key patterns, and using trend lines to anticipate price movements. By mastering oscillators and other technical indicators, traders can determine when to enter and exit trades, maximizing their chances of capturing large market swings aligned with the quarterly cycle.

How Does the Trader Daye Quarterly Theory Encourage Patience and Discipline?

One of the distinguishing features of the Trader Daye Quarterly Theory 2024 course is its emphasis on patience and discipline. Unlike many trading strategies that encourage rapid trading and short-term gains, the Trader Daye approach advocates for waiting for the right opportunities—trades that align with the broader quarterly cycle.

Reducing the Impact of Market Noise

Market noise refers to the short-term fluctuations that often cause traders to make impulsive decisions. The Trader Daye Quarterly Theory 2024 course teaches traders how to reduce the impact of this noise by focusing on larger market trends. By staying patient and waiting for high-probability trades, participants can avoid the pitfalls of overtrading and reactive decision-making.

Cultivating a Disciplined Trading Mindset

Trader Daye emphasizes the importance of discipline in trading. Participants will learn strategies for managing their emotions, setting realistic trading goals, and sticking to their quarterly cycle strategy even when the markets are volatile. This disciplined approach helps traders avoid costly mistakes and promotes consistent, long-term profitability.

What Risk Management Techniques Are Taught in the Trader Daye Quarterly Theory Course?

Risk management is a critical component of any successful trading strategy, and the Trader Daye Quarterly Theory 2024 course offers comprehensive guidance on how to protect your capital while maximizing returns. By employing techniques such as position sizing, stop-loss orders, and diversification, traders can mitigate risk and maintain profitability, even in challenging market conditions.

Position Sizing for Effective Risk Control

Position sizing is a key risk management technique that helps traders control their exposure to risk on any given trade. In the Trader Daye Quarterly Theory 2024 course, participants will learn how to size their trades appropriately based on their account balance, risk tolerance, and the specific characteristics of the trade. This ensures that no single trade has the potential to wipe out a significant portion of their capital.

Implementing Stop-Loss Orders and Diversification

Stop-loss orders are another vital tool for managing risk. The Trader Daye Quarterly Theory 2024 course teaches traders how to set effective stop-loss levels that protect their capital while still allowing for the natural fluctuations of the market. Additionally, diversification is covered as a strategy to spread risk across multiple assets, reducing the impact of a poor-performing trade or sector.

Who Can Benefit from the Trader Daye Quarterly Theory 2024 Course?

The Trader Daye Quarterly Theory 2024 course is suitable for traders of all experience levels. Whether you’re new to trading or have years of experience, the course provides valuable insights that can enhance your trading performance.

The emphasis on long-term trends and disciplined trading makes this course particularly well-suited for those who prefer a strategic, patient approach to the markets.

Beginner Traders Looking to Build a Strong Foundation

For novice traders, the Trader Daye Quarterly Theory 2024 course offers a solid foundation in market analysis, risk management, and trading psychology. By focusing on long-term trends, beginners can learn how to make informed trading decisions that align with the broader market cycles, avoiding the temptation to chase short-term gains.

Experienced Traders Seeking to Refine Their Strategy

Experienced traders can also benefit from the Trader Daye Quarterly Theory 2024 course by refining their existing strategies and gaining new insights into market cycles. The combination of fundamental analysis, technical analysis, and disciplined risk management provides a comprehensive framework for enhancing profitability and maintaining consistency in trading results.

Conclusion: Why the Trader Daye Quarterly Theory 2024 Course Is Essential for Traders

The Trader Daye Quarterly Theory 2024 Course offers a unique and powerful approach to trading that focuses on quarterly cycles and long-term trends. By aligning your trading strategy with these broader market movements, you can position yourself for higher-probability trades, avoid impulsive decisions, and protect your capital through disciplined risk management.

Whether you’re a beginner trader looking to build a strong foundation or an experienced trader seeking to refine your strategy, the Trader Daye Quarterly Theory 2024 course provides the tools and knowledge you need to succeed in today’s dynamic trading environment.

This course empowers traders to achieve their goals and build long-term profitability by providing a comprehensive framework that combines fundamental analysis, technical analysis, and sound risk management.

Join the Trader Daye Quarterly Theory 2024 Course today and start mastering the markets with a strategic, patient approach leveraging long-term trends’ power!