Leila Gharani – Fundamentals of Financial Analysis

Original price was: $997.00.$30.00Current price is: $30.00.

Leila Gharani – Fundamentals of Financial Analysis

Leila Gharani – Fundamentals of Financial Analysis: Unlock the Power of Financial Data

In today’s fast-paced business world, making informed financial decisions is crucial for success. However, understanding financial data can be a daunting task, especially for those without a background in finance.

That’s where Leila Gharani’s Fundamentals of Financial Analysis course comes in – a comprehensive online program designed to equip you with the skills to analyze financial data and make informed decisions.

Why is Financial Analysis Essential for Your Success?

The Fundamentals of Financial Analysis course, developed by Leila Gharani, is a six-week online program that will help you master the fundamentals of financial analysis. Focusing on practical skills and real-world applications, this course will teach you how to analyze financial statements, identify trends, and make informed decisions.

What Will You Learn in This Course?

Leila Gharani’s Fundamentals of Financial Analysis course is meticulously structured to provide you with a thorough understanding of financial analysis. Divided into six comprehensive modules, each module focuses on a specific aspect of financial analysis:

- Introduction to Financial Analysis

- Overview of financial analysis and its importance

- Key concepts and terminology

- Setting goals and objectives for financial analysis

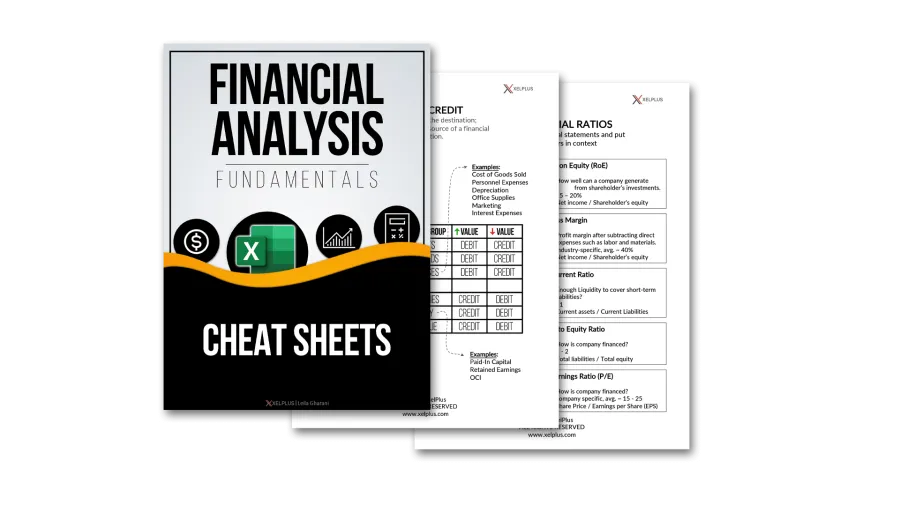

- Financial Statement Analysis

- Balance sheet analysis: assets, liabilities, equity, and ratios

- Income statement analysis: revenues, expenses, and profitability

- Cash flow statement analysis: cash inflows and outflows

- Ratio Analysis

- Types of ratios: liquidity, profitability, efficiency, and solvency

- How to calculate and interpret ratios

- Common pitfalls and limitations of ratio analysis

- Financial Statement Modeling

- Introduction to financial modeling and forecasting

- Building a financial model using Excel

- Best practices for modeling and forecasting

- Advanced Financial Analysis Techniques

- Scenario analysis: what-if scenarios and sensitivity analysis

- Monte Carlo simulations: risk analysis and forecasting

- Data visualization techniques for financial data

- Putting it All Together – Case Studies

- Real-world case studies and examples

- Applying financial analysis techniques to real-world scenarios

- Best practices for reporting and presenting financial analysis results

Why Choose Leila Gharani’s Fundamentals of Financial Analysis Course?

What are the Core Benefits?

By enrolling in the Fundamentals of Financial Analysis course, you will gain:

- A Comprehensive Understanding of Financial Analysis Principles and Best Practices: Learn the fundamental concepts that underpin financial analysis, from basic terminology to advanced techniques.

- Practical Skills for Analyzing Financial Statements and Ratios: Develop the ability to dissect financial statements and extract meaningful insights from various financial ratios.

- The Ability to Build a Financial Model Using Excel: Master the art of creating robust financial models that can forecast future financial performance.

- A Deeper Understanding of Scenario Analysis, Monte Carlo Simulations, and Data Visualization Techniques: Equip yourself with advanced tools to analyze risks, predict outcomes, and present data effectively.

- A Framework for Putting It All Together in Real-World Scenarios: Apply your knowledge to real-life case studies and scenarios, ensuring you can make informed decisions in any business context.

Who Should Take This Course?

- Finance Professionals Looking to Improve Their Analytical Skills: Enhance your existing skills and stay ahead in the competitive world of finance.

- Business Owners Who Want to Understand Their Company’s Financials: Gain the knowledge needed to make informed decisions and drive your business towards success.

- Investors Seeking to Analyze Investment Opportunities: Learn how to assess potential investments and make sound financial decisions.

- Anyone Interested in Learning the Fundamentals of Financial Analysis: Whether you are starting a career in finance or looking to gain a new skill set, this course is perfect for you.

How is This Course Structured?

What Does Each Module Offer?

Module 1: Introduction to Financial Analysis

- Begin your journey with a comprehensive overview of financial analysis, its importance, and the key concepts and terminology you will need to understand. This module sets the foundation for the entire course, helping you set goals and objectives for your financial analysis journey.

Module 2: Financial Statement Analysis

- Dive into the intricacies of balance sheets, income statements, and cash flow statements. Learn to analyze assets, liabilities, equity, revenues, expenses, and cash flows to understand a company’s financial health.

Module 3: Ratio Analysis

- Discover the different types of financial ratios and how to calculate and interpret them. This module will teach you about liquidity, profitability, efficiency, and solvency ratios, and help you understand ratio analysis’s common pitfalls and limitations.

Module 4: Financial Statement Modeling

- Learn the essentials of financial modeling and forecasting. This module focuses on building Excel financial models, ensuring you understand the best practices for accurate modeling and forecasting.

Module 5: Advanced Financial Analysis Techniques

- Explore advanced techniques such as scenario analysis, Monte Carlo simulations, and data visualization. These tools will allow you to perform risk analysis, forecast outcomes, and present data compellingly.

Module 6: Putting It All Together – Case Studies

- Apply everything you have learned in real-world case studies. This module will help you practice your skills and understand how to effectively report and present financial analysis results.

What Makes Leila Gharani’s Course Stand Out?

Why Invest in This Course?

Investing in the Leila Gharani Fundamentals of Financial Analysis course means investing in your future. With a curriculum designed by an industry expert, this course offers:

- Expert Instruction: Learn from Leila Gharani, a seasoned professional with a wealth of experience in financial analysis.

- Practical Applications: Gain hands-on experience with real-world examples and exercises that prepare you for practical application in your career.

- Flexibility: As a 6-week online program, you can learn quickly, fitting the course into your busy schedule.

Conclusion: Is This Course Right for You?

Leila Gharani’s Fundamentals of Financial Analysis course is a valuable resource for anyone looking to gain a deeper understanding of financial analysis.

With its comprehensive approach, practical exercises, and real-world examples, this course is an essential tool for anyone looking to improve their analytical skills and make informed financial decisions.

Whether you are a finance professional, a business owner, an investor, or simply someone eager to learn, this course provides the knowledge and skills you need to succeed in the world of financial analysis.

Invest in your future today with Leila Gharani’s Fundamentals of Financial Analysis course and unlock the power of financial data to make smarter, more informed decisions.