The Macrocompass – Monetary Mechanics Course

The Macrocompass – Monetary Mechanics Course: Master the World of Monetary Mechanics

Are you ready to investigate the inner workings of monetary systems and truly understand how money operates globally?

The Monetary Mechanics Course by The Macrocompass, led by Alf, provides a step-by-step breakdown of the complex monetary mechanisms that drive economies, financial markets, and monetary policy.

This course demystifies key concepts like liquidity, money printing, and the intricate operations behind monetary plumbing, ensuring you understand these vital economic forces.

Suppose you’re an investor, financial professional, or someone keen on understanding how central banks, liquidity, and money creation affect the economy.

In that case, the Monetary Mechanics Course is an invaluable resource that will provide you with the knowledge and confidence to navigate the complexities of modern monetary systems.

What Will You Learn in the Monetary Mechanics Course?

What Is Liquidity and Why Is It So Important?

In the first lesson of the Monetary Mechanics Course, Alf tackles the often-heard but rarely understood concept of liquidity. This module explains not just what liquidity is, but how it operates within the broader monetary system, focusing on its origins and implications.

- Understanding Liquidity

- Liquidity is often referenced as the lifeblood of financial markets, but what does that really mean? Alf breaks down liquidity as the first tier of money, explaining how it moves through central banks, financial institutions, and the wider economy. You’ll get a clear understanding of where liquidity comes from, how it’s created, and how it fuels financial markets.

- Central Bank Balance Sheets and Liquidity Creation

- One of the key insights of this lesson is how central bank balance sheets operate to control liquidity. You’ll learn how central banks manage liquidity, including the role of tools like open market operations, quantitative easing (QE), and how these measures impact interest rates, inflation, and asset prices.

How Does Real-Economy Money Differ from Liquidity?

Lesson 2 dives into real-economy money, the second tier of money, which operates differently from the liquidity injected by central banks. This module explores how money is created in the real economy and its impact on inflation and market behavior.

- Who Prints Real-Economy Money?

- In this lesson, you’ll uncover the distinction between liquidity (created by central banks) and real-economy money, which is often generated through private sector lending. Alf explains how money moves from the financial system into the real economy, and how this process can lead to inflationary pressures when too much money chases too few goods.

- Inflation and Real-Economy Money Printing

- Alf takes you through the steps of how inflation is linked to money printing in the real economy. You’ll gain insights into who really creates inflationary money, how this affects consumer prices, and the long-term consequences for markets and economies.

What Are Monetary Plumbing Operations and Why Do They Matter?

Monetary plumbing is a term often used but rarely fully understood. Lesson 3 of the Monetary Mechanics Course uncovers the intricate mechanics behind operations like reverse repos, the Treasury General Account (TGA), and various central bank programs.

By the end of this lesson, you’ll never be confused by these terms again.

- Monetary Plumbing Demystified

- Alf simplifies the complex world of monetary plumbing, explaining how different operations maintain money flow within the banking system. You’ll learn about reverse repos, the Treasury General Account, and how these mechanisms influence short-term interest rates, liquidity, and financial stability.

- Understanding Key Programs

- The course also dives into specific programs such as the Bank Term Funding Program, helping you understand how central banks use these tools to stabilize the financial system during periods of stress. By mastering the plumbing of the monetary system, you’ll be better equipped to anticipate market reactions to changes in central bank policies.

Why Should You Take the Monetary Mechanics Course?

How Will This Course Help You Understand Modern Financial Systems?

The Monetary Mechanics Course offers an unparalleled opportunity to understand the fundamental mechanics that underpin global financial systems.

Alf’s easy-to-follow explanations allow you to grasp complex concepts that many financial professionals struggle with, making it a must-have for anyone interested in understanding how money, liquidity, and monetary policy interact to drive markets.

- Clear Explanations of Complex Topics

- The course doesn’t just explain what liquidity or monetary plumbing is—it connects the dots, showing how these concepts interact with each other to influence broader market trends. Alf’s ability to break down these topics into digestible lessons makes the Monetary Mechanics Course accessible to both beginners and seasoned professionals.

- Step-by-Step Framework

- Each lesson in the course builds on the previous one, providing a cohesive learning experience. By the end of the course, you’ll have a complete understanding of how money moves through the economy and how central banks’ actions influence everything from interest rates to asset prices.

Who Is the Monetary Mechanics Course For?

Whether you’re an investor, trader, financial analyst, or just someone who wants to understand how the monetary system works, the Monetary Mechanics Course by The Macrocompass is designed to meet your needs.

- For Investors and Traders

- Knowing how central banks manage liquidity and control money supply is crucial for understanding market behavior. This course will help you better predict market trends and make more informed investment decisions by revealing the underlying forces that drive asset prices.

- For Financial Professionals

- The financial industry is filled with jargon that can be difficult to interpret. Alf’s course breaks down complex concepts like reverse repos, real-economy money, and monetary plumbing in a way that’s clear and actionable. By the end of the course, you’ll be able to discuss these topics with confidence, giving you an edge in your professional career.

How Does the Monetary Mechanics Course Improve Your Market Insights?

Understanding monetary mechanics gives you a significant edge when analyzing market movements. Central bank actions, liquidity injections, and changes in money supply often precede shifts in asset prices. By mastering these concepts, you’ll be able to anticipate market reactions to policy changes and position yourself to capitalize on new opportunities.

- Navigate Market Volatility with Confidence

- Markets can become volatile when central banks change monetary policy, but with the insights gained from this course, you’ll be able to interpret these changes and adjust your strategies accordingly. Whether it’s a new round of quantitative easing or shifts in interest rates, you’ll have the knowledge to navigate uncertain markets with confidence.

- Gain a Deeper Understanding of Inflation Dynamics

- Inflation is one of the most important drivers of long-term market trends, yet few truly understand how it’s created. This course provides you with the tools to analyze inflation dynamics by breaking down the processes that lead to inflationary pressures in both the financial and real economy.

What Bonus Materials Are Included in the Course?

The Monetary Mechanics Course comes with a comprehensive recap that summarizes the key concepts you’ve learned throughout the course. This bonus module ensures that you walk away with a solid understanding of how liquidity, real-economy money, and monetary plumbing work together to shape the economy.

- Course Recap

- The final section of the course provides a detailed summary of the most important lessons. Alf revisits each of the core concepts and reinforces the connections between them, ensuring that you retain the information long after the course is over.

- Exclusive Access to Alf’s Insights

- As a student of the course, you’ll gain exclusive access to additional insights and resources from Alf and The Macrocompass. This ensures that your learning continues as you apply the concepts in real-world scenarios.

Final Thoughts: Master the Monetary System with the Monetary Mechanics Course

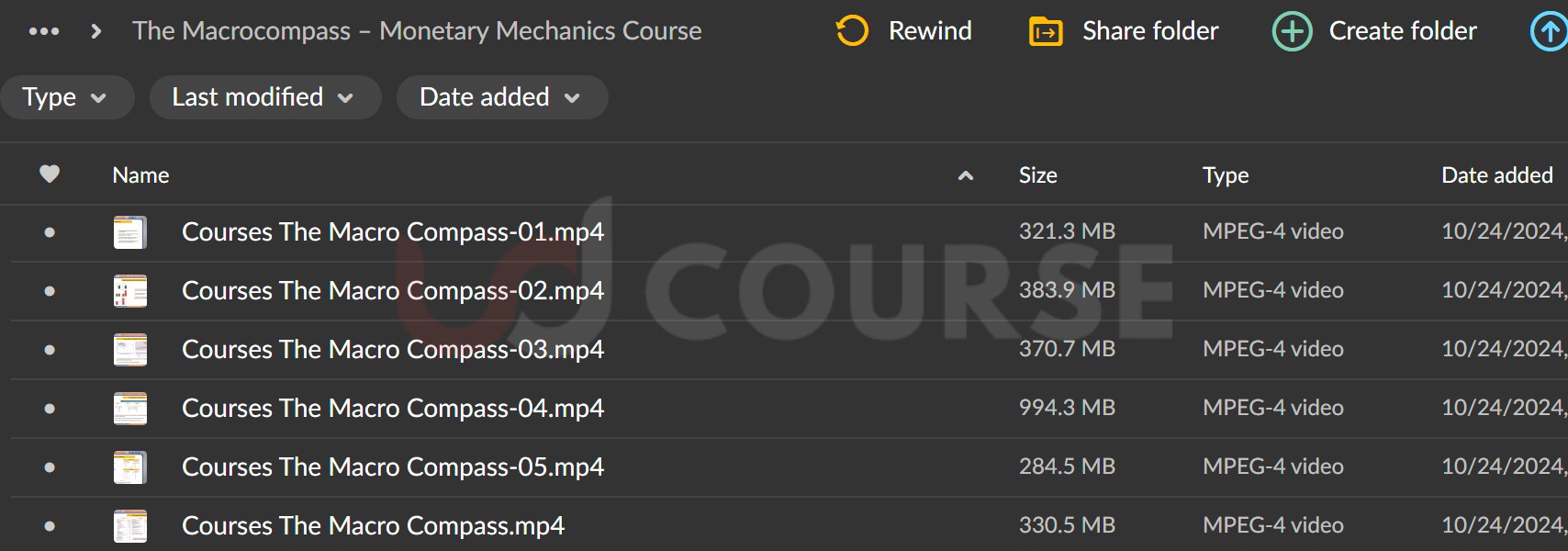

The The Macrocompass – Monetary Mechanics Course is an essential resource for anyone looking to gain a deeper understanding of the monetary system.

With Alf’s expert guidance, you’ll learn how liquidity, money creation, and monetary plumbing drive financial markets and influence economic policy.

Whether you’re an investor, financial professional, or simply someone who wants to understand the mechanics of money, this course offers the clear, actionable insights you need to succeed.

Don’t miss the opportunity to transform your understanding of the monetary system.

Enroll today in the Monetary Mechanics Course and take your financial knowledge to the next level!