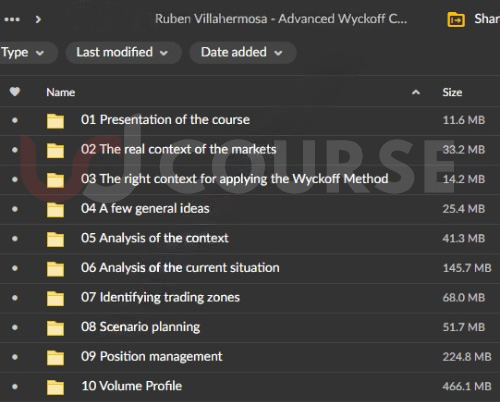

Ruben Villahermosa – Advanced Wyckoff Course + Volume Profile

Ruben Villahermosa – Advanced Wyckoff Course + Volume Profile: Master Market Structure and Precision Trading

The Ruben Villahermosa – Advanced Wyckoff Course + Volume Profile is a cutting-edge trading course designed for intermediate and advanced traders looking to elevate their technical analysis skills.

Combining the principles of the Wyckoff Method with Volume Profile analysis, this course offers a powerful framework to help traders better understand market behaviour, anticipate key turning points, and execute trades with greater accuracy.

Led by renowned Wyckoff expert Ruben Villahermosa, this course delves into the core elements of price action, volume dynamics, and market structure. With a focus on real-time application, participants will learn how to interpret market forces through supply and demand, gaining an edge in both day trading and swing trading.

The Advanced Wyckoff Course Volume Profile is ideal for refining your trading strategies and improving market timing.

Why Should You Choose the Advanced Wyckoff Course + Volume Profile?

What Will You Learn in the Ruben Villahermosa Course?

The Advanced Wyckoff Course Volume Profile course is structured around two robust trading methodologies: the Wyckoff Method, which focuses on the relationship between price and volume, and the Volume Profile tool, which reveals the distribution of trading activity at specific price levels. Here’s an overview of the course’s key topics:

Advanced Wyckoff Methodology: Mastering Market Cycles and Phases

The course starts by diving deep into the Wyckoff Method, one of the most respected frameworks in technical analysis. You’ll explore accumulation, distribution, price cycles, and market phases. This module teaches you how to:

- Identify Accumulation and Distribution Phases: Learn to recognize when “smart money” or institutional players are accumulating or distributing assets. Understanding these phases allows you to anticipate future price movements and make informed trading decisions.

- Analyze Price and Volume Dynamics: Discover how to read price action about volume to uncover market trends, momentum shifts, and turning points.

- Predict Market Movements: The Wyckoff Method comprehensively explains how market cycles unfold. This course equips you with the tools to predict where the market is heading and adjust your strategies accordingly.

Mastering Wyckoff’s price-volume principles allows you to interpret the market more effectively and make decisions based on institutional activity.

Volume Profile Analysis: Precision in Identifying Support and Resistance

The next component of the course introduces the Volume Profile tool, an essential addition to Wyckoff’s methodology. Volume Profile shows the distribution of trading activity across price levels, providing a unique perspective on market behaviour. Here’s what you’ll learn:

- Pinpoint Key Price Levels: Using Volume Profile, you can identify areas with the highest concentration of trading activity. These levels act as strong support or resistance, helping you make more precise entries and exits.

- Spotting Market Imbalances: Volume Profile allows traders to detect imbalances in supply and demand, which can signal potential reversals or breakouts. This tool adds an extra layer of precision to Wyckoff’s analysis, enabling better timing of trades.

- Enhancing Market Timing: With the insights provided by Volume Profile, you’ll gain a clearer picture of where the market is likely to pause or reverse, giving you an edge in executing trades with precision.

Combining Wyckoff with Volume Profile enhances your ability to navigate the markets by offering a deeper understanding of market structure.

How Does the Advanced Wyckoff Course Help You Navigate Market Structure and Phases?

One of the most valuable lessons in the Ruben Villahermosa course is understanding market structure and how it progresses through different phases. By recognizing these phases, traders can position themselves for optimal opportunities. Here’s how the course helps:

- Recognizing Market Phases: The course breaks down key market phases, such as accumulation, distribution, mark-up, and mark-down. Each phase offers unique trading opportunities, and understanding where the market is in its cycle is crucial for profitable trading.

- Interpreting Market Cycles: Villahermosa explains how markets move in cycles and how to spot early signs of phase transitions. Whether the market is entering a period of strength or weakness, this knowledge allows you to anticipate movements and adjust your positions accordingly.

- Timing Your Trades: Armed with a clear understanding of market phases, you’ll be able to enter and exit trades at the most opportune moments, reducing risk and maximizing reward.

This module is designed to give traders the clarity to make informed decisions based on market structure, allowing for more strategic trade placement.

What Are the Trade Entry and Exit Strategies Taught in the Course?

The Advanced Wyckoff Course Volume Profile course goes beyond theory, offering practical, actionable strategies for entering and exiting trades with precision. Here’s what you can expect to learn:

- Timing Entries During Accumulation and Distribution Phases: The course provides detailed strategies for identifying the best times to enter positions during periods of accumulation (buying) and distribution (selling). Villahermosa offers a step-by-step guide on how to capitalize on these market phases.

- Exit Strategies During Strength and Weakness: Knowing when to exit is just as important as knowing when to enter. This module covers strategies for exiting trades during phases of market strength or weakness, helping you lock in profits or minimize losses.

- Real-World Examples: Villahermosa uses real-world market examples to demonstrate these strategies, ensuring participants understand how to apply them in various market conditions.

By learning these advanced entry and exit techniques, traders can significantly improve their market performance.

How Does the Course Cover Risk Management and Position Sizing?

Risk management is a critical component of successful trading, and the Ruben Villahermosa course strongly emphasises teaching traders how to protect their capital while optimizing potential rewards. Here’s what you’ll learn:

- Stop Placement Strategies: Properly placing stop-loss orders is essential for minimizing risk. The course provides detailed guidelines on how to set stops based on market structure, volatility, and other factors.

- Position Sizing: Villahermosa covers the importance of position sizing, showing traders how to calculate the optimal size of each trade based on their risk tolerance and the specific market conditions.

- Risk-Reward Ratios: The course teaches how to calculate and manage risk-reward ratios to ensure that each trade has the potential to offer a favorable return relative to the risk taken.

With these risk management tools, traders can protect their capital while maximizing their profit potential in the market.

What Makes the Advanced Wyckoff Course + Volume Profile Beneficial for Traders?

The Advanced Wyckoff Course Volume Profile course offers several key benefits for traders looking to take their skills to the next level:

- Comprehensive Understanding of Wyckoff: This course provides one of the most detailed analyses available for traders who want to master the Wyckoff Method. Villahermosa’s expertise makes complex concepts accessible and applicable in real-world trading.

- Enhanced Market Timing: The integration of Volume Profile with Wyckoff’s principles gives traders an advantage in pinpointing critical market levels. This combination helps traders improve their timing in both entering and exiting trades, leading to more accurate decisions.

- Actionable Strategies: The course offers practical strategies that traders can start using immediately. Whether you’re day trading or swing trading, the strategies taught in this course are applicable across various timeframes and market conditions.

- Improved Risk Management: Along with advanced technical analysis, the course emphasizes the importance of managing risk. Traders will learn essential skills for protecting capital while optimizing potential gains.

This course provides a comprehensive framework for success for traders who are serious about improving their market timing, trade execution, and risk management.

Who Should Take the Ruben Villahermosa Course?

The Advanced Wyckoff Course Volume Profile course is designed for:

- Intermediate to Advanced Traders: If you already have a basic understanding of technical analysis and are looking to deepen your knowledge, this course is perfect for you. It dives deep into advanced concepts that will help you refine your trading strategies.

- Day and Swing Traders: Whether you prefer day trading or swing trading, this course provides valuable insights and tools to enhance your approach to the markets.

- Traders Seeking Market Mastery: If your goal is to master market structure, price action, and volume dynamics, this course offers the comprehensive knowledge and tools you need to achieve that mastery.

Conclusion: Why the Advanced Wyckoff Course + Volume Profile Is a Must for Serious Traders

The Ruben Villahermosa – Advanced Wyckoff Course + Volume Profile is a powerful program for traders who want to master the intricacies of market structure and improve their decision-making in the markets.

By combining the Wyckoff Method with Volume Profile analysis, Villahermosa provides a robust framework for understanding supply and demand dynamics, timing trade entries and exits, and managing risk effectively.

If you’re ready to take your trading to the next level, the Advanced Wyckoff Course Volume Profile course offers the insights, strategies, and tools you need to succeed.

Enroll today and gain the skills to navigate the markets precisely and confidently.