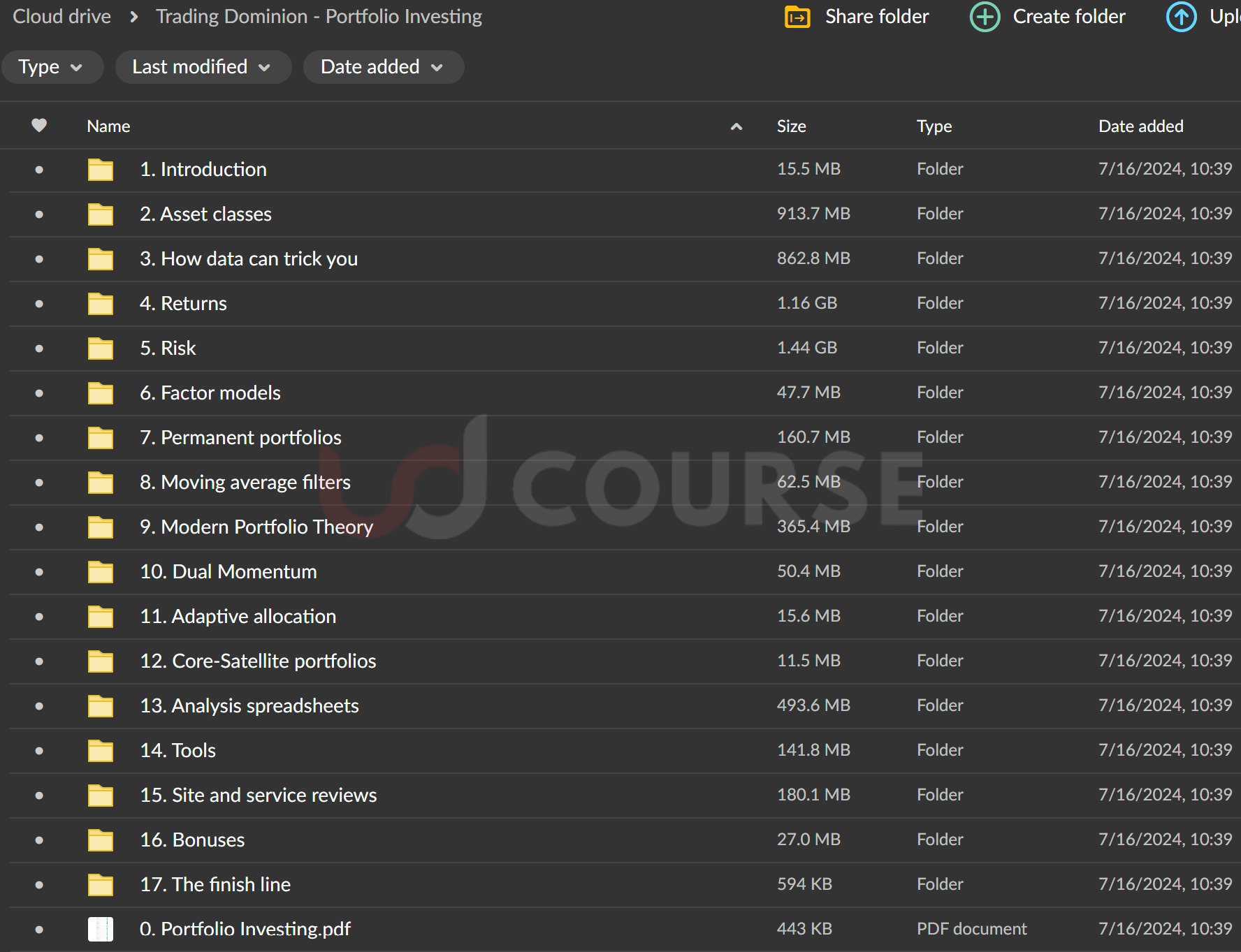

Trading Dominion – Portfolio Investing

Trading Dominion – Portfolio Investing

Original price was: $397.00.$32.00Current price is: $32.00.

5.87 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose UDCourse?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Trading Dominion – Portfolio Investing

Master Your Investments with the Portfolio Investing Course

Are you looking to control your own investments and understand key financial concepts confidently? The Trading Dominion – Portfolio Investing course is designed to help you achieve just that.

In just a few hours, you’ll gain the knowledge to navigate the complexities of portfolio investing, access pre-made portfolios to start trading immediately, and join a supportive community of traders.

Discover why this course is a must-have for anyone serious about mastering portfolio investing.

Why Choose the Portfolio Investing Course?

The Portfolio Investing course from Trading Dominion offers a comprehensive introduction to portfolio investing, covering everything from basic financial concepts to advanced investment strategies.

Whether you’re a beginner or an experienced investor, this course will equip you with the tools and knowledge needed to make informed investment decisions.

What Will You Learn in the Portfolio Investing Course?

How Does Strategic vs. Tactical Asset Allocation Affect Your Portfolio?

Understanding asset allocation is fundamental to portfolio investing. This course covers:

- Strategic Asset Allocation: Learn how to set long-term investment goals and allocate assets accordingly.

- Tactical Asset Allocation: Discover how to adjust your portfolio based on market conditions and economic forecasts.

What Are the Key Asset Classes and How Do They Impact Your Investments?

The course provides a thorough introduction to various asset classes:

- Bonds: Understand the role of bonds in a diversified portfolio.

- Hedge Funds: Learn about the strategies and benefits of including hedge funds in your investment mix.

- Other Asset Classes: Explore different asset classes and their risk-return profiles.

How to Analyze and Interpret Financial Data?

How Can Historical Data and Price Returns Guide Your Investments?

The course teaches you to analyze historical data effectively:

- Getting Historical Data: Learn how to source and interpret historical financial data.

- Linear vs. Log Scale: Understand the differences between linear and logarithmic price scales.

- Price Returns: Calculate arithmetic and log price returns to evaluate investment performance.

How to Measure and Manage Risk in Your Portfolio?

Risk management is a crucial aspect of investing. This course covers:

- Risk Metrics: Learn to measure risk using variance, standard deviation, and other metrics.

- Risk Ratios: Understand key risk ratios such as Sharpe, Sortino, Calmar, and Martin ratios.

- Value-At-Risk (VaR): Calculate and interpret Value-At-Risk and Expected Shortfall.

What Advanced Theories and Models Will You Learn?

How Do Factor Models and Capital Asset Pricing Model (CAPM) Enhance Your Investing?

The course dives into advanced financial models:

- Factor Models: Explore the Fama French 3 factor model and its applications.

- CAPM: Understand the Capital Asset Pricing Model and how it influences investment decisions.

How to Build and Manage Portfolios Using Modern Portfolio Theory (MPT)?

Modern Portfolio Theory (MPT) is a cornerstone of investment strategy:

- Introduction to MPT: Learn the fundamentals of Modern Portfolio Theory.

- Efficient Frontier: Discover how to construct efficient portfolios that maximize returns for a given level of risk.

- Rebalancing: Understand the importance of portfolio rebalancing to maintain optimal asset allocation.

What Pre-Made Portfolios Are Available?

How to Utilize Permanent Portfolios for Long-Term Stability?

Permanent portfolios are designed for long-term stability:

- Review of Permanent Portfolios: Evaluate five different permanent portfolios and their performance.

- Equal and Value Weighting: Learn the differences between equal and value weighting in portfolio construction.

How to Apply Dual Momentum and Adaptive Allocation Strategies?

Advanced strategies like Dual Momentum and Adaptive Allocation can enhance returns:

- Dual Momentum: Review six different dual momentum portfolios and their benefits.

- Adaptive Allocation: Analyze two adaptive allocation portfolios to understand their flexibility.

How to Join and Benefit from the Trading Community?

What Are the Advantages of Joining a Private Trading Community?

Networking and support are crucial for successful investing:

- Community Access: Join a private community of traders to share insights and strategies.

- Peer Support: Benefit from hundreds of traders’ collective knowledge and experience.

How to Leverage Community Resources for Continuous Learning?

Continuous learning is vital for investment success:

- Ongoing Education: Access regular updates, discussions, and educational resources within the community.

- Collaborative Growth: Work together with fellow traders to grow and improve your investment strategies.

Course Benefits: What Will You Gain?

How Does the Course Enhance Your Investment Skills?

The Portfolio Investing course offers numerous benefits for investors:

- Skill Development: Enhance your ability to analyze markets and construct diversified portfolios.

- Strategic Thinking: Develop a strategic approach to investing that maximizes returns and minimizes risks.

How Does the Course Support Professional Growth?

For those looking to advance their career in finance or investing, this course is invaluable:

- Professional Advancement: Equip yourself with the skills and knowledge to excel in portfolio management.

- Networking Opportunities: Connect with other investors and industry experts through the course community.

Success Stories: What Results Can You Expect?

Real-Life Testimonials: How Have Others Benefited?

Hear from investors who have successfully implemented the strategies from this course:

- User Feedback: Positive reviews from participants who have significantly improved their investment portfolios.

- Case Studies: Detailed examples of how the course has transformed investment strategies and boosted returns.

Pros and Cons: What Should You Consider Before Enrolling?

Pros: Why is This Course a Valuable Investment?

- Comprehensive Content: Covers all aspects of portfolio investing from basic concepts to advanced strategies.

- Actionable Insights: Provides practical tips and strategies that can be implemented immediately.

- Expert Guidance: Learn from experienced professionals in the field of portfolio management.

Cons: What Are the Potential Drawbacks?

- Time Commitment: Requires dedication and time to benefit from the course fully.

- Initial Cost: May involve a higher upfront investment, but offers substantial long-term value.

Conclusion: Why Should You Choose the Portfolio Investing Course?

The Trading Dominion—Portfolio Investing course is a comprehensive program for anyone looking to master portfolio investing.

It focuses on asset allocation, risk management, and advanced investment strategies, providing everything you need to succeed in the financial markets.

This course offers the tools and knowledge necessary for success, whether you are a beginner or an experienced investor.

Take control of your financial future.

Enroll in the Portfolio Investing course today and start your journey towards confident, informed investing.

Join a community of successful investors and unlock the potential of your investment portfolio.