Axia Futures – Futures Trading and Trader Development

If you’re looking for online training that will take you from the ground up and turn you into a professional futures trader, Futures Trading and Trader Development is the course for you. It is regarded as a Bootcamp with eight intensive training days that provide you with all of the fundamental knowledge and skills required to maximize your profits. The quizzes and recaps are available on demand after each day, allowing you to easily summarize what you have learned from the course.

Axia Futures Takes a Closer Look at Futures Trading and Trader Development

You will learn the fundamentals of futures trading over the first three days. Goal setting, analysis techniques, volume profiles, price ladders, and so on are all explicitly instructed. Axia Futures Futures trading is designed in a flow where you collect all the information that is a prerequisite for the next session. The fifth training day, for example, begins with a walk-through of charts that includes candlesticks, patterns, entries, and exits, as well as volatility indicators such as VWAP, ATR, volume/delta, and so on.

Futures Trading and Trader Development by Axia Futures guides you through the process of transforming valuable insights from technical analysis into viable strategy development by leveraging the knowledge gained in the first five days. The how-tos and necessary management and adjustments are delivered in a logical manner, which boosts your energy and confidence to jump into the simulator trading platform. Such sessions are provided for free as part of the course to provide hands-on experience in your quest to become a professional futures trader.

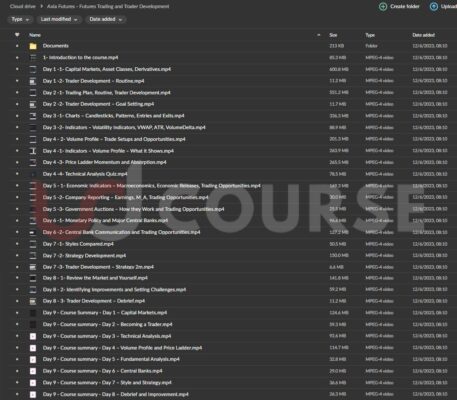

DAY 1 – MARKETS

Capital Markets, Asset Classes, Derivatives

Trader Development – Routine

DAY 2 – BECOMING A TRADER

Trading Plan, Routine, Trader Development

Trader Development – Goal Setting

DAY 3 – TECHNICAL ANALYSIS

Charts – Candlesticks, Patterns, Entries and Exits

Indicators – Volatility Indicators, VWAP, ATR, Volume/Delta

DAY 4 – VOLUME PROFILE AND PRICE LADDER

Volume Profile – What it Shows

Volume Profile – Trade Setups and Opportunities

Price Ladder Momentum and Absorption

Technical Analysis Quiz

DAY 5 – FUNDAMENTAL ANALYSIS

Economic Indicators – Macroeconomics, Economic Releases, Trading Opportunities

Company Reporting – Earnings, M&A, Trading Opportunities

Government Auctions – How they Work and Trading Opportunities

DAY 6 – CENTRAL BANKS

Monetary Policy and Major Central Banks

Central Bank Communication and Trading Opportunities

Fundamental Analysis Quiz

DAY 7 – STYLE AND STRATEGY

Styles Compared

Strategy Development

Trader Development – Strategy

DAY 8 – DEBRIEF AND IMPROVEMENT

Review the Market and Yourself

Identifying Improvements and Setting Challenges

Trader Development – Debrief

DAY 9 – SUMMARY

Course Summary

SIZE: 3,8 GB